Award-winning PDF software

Printable Form Instructions 8938 San Diego California: What You Should Know

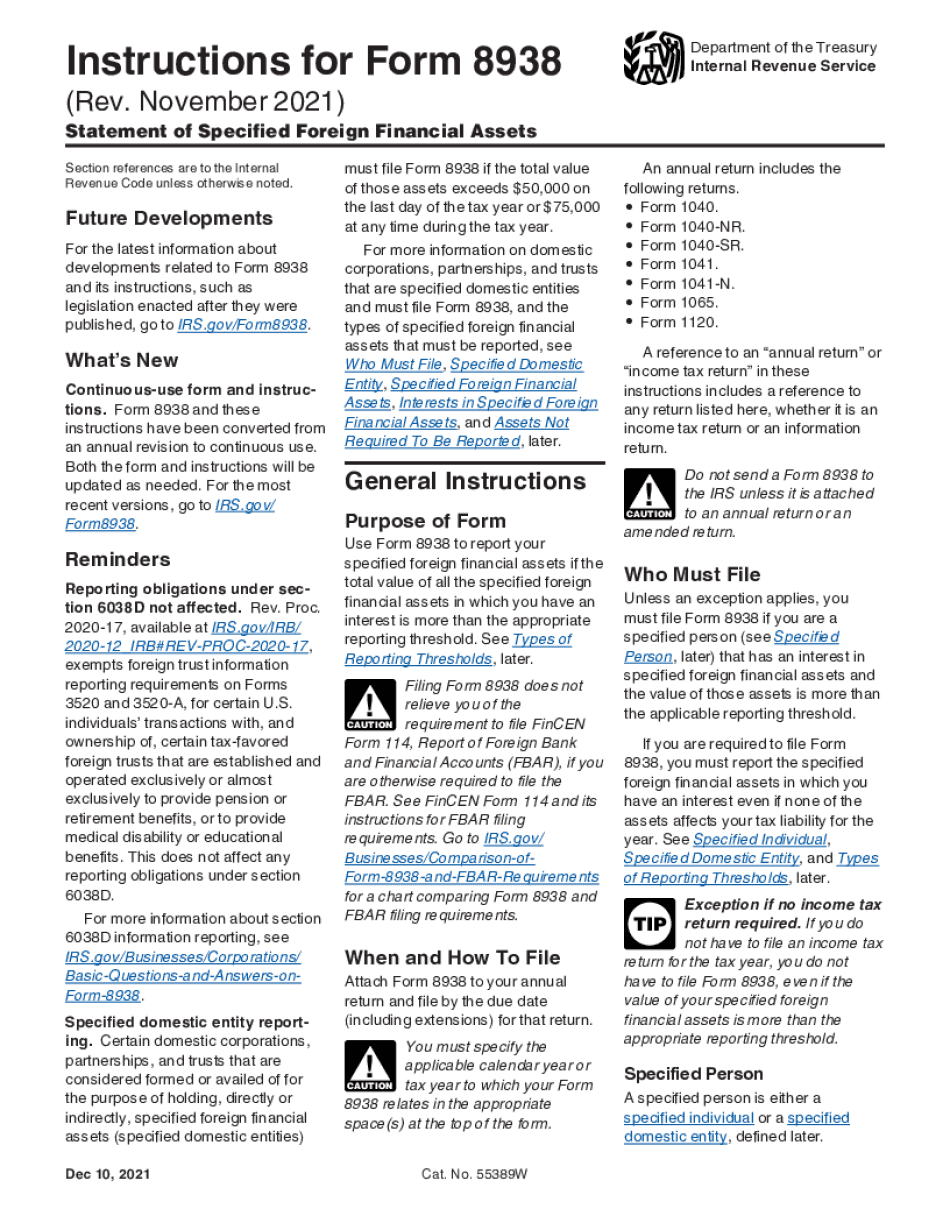

The information shown includes the information available electronically. The information shown in this table reflects both the new and traditional version of the Form 114. Information Available in Form 114 of Fin CEN Form 114 Form 8938 and Forms 8938s on IRS.gov: If Form 8938 is used with IRS Form 8821, Financial Institution Identification Number or FFI #, to report a foreign financial account, then you must also file Form 8938 to report your specified foreign assets. In addition, if you did not use IRS Form 8821, Financial Institution Identification Number or FFI #, to report your foreign financial assets, or if you did, you may file Form 8938 as your only form of payment of income taxes for the tax period, but you must also file Form 8938 as your only form of payment of estate or donor taxes. This is because these payments involve two different transactions. IRS Form 8938 has been developed with the goal of assisting taxpayers in understanding that reporting foreign financial assets on Form 8938. Required Financial Statements Any non-resident alien individual or foreign corporation that has a Form 8938 for an applicable reporting period, and who pays or provides any money or property to another person, in this taxable year, in the possession or control of such individual or corporation shall provide the following information with respect to the payment or provision: the name and residence address of the recipient or recipient's U.S. account for the payment or provision and the account number; the type of property delivered, including an inventory of all property, or noncash services provided, including any service performed by a broker to facilitate the payment or provision, to the recipient; the type of property delivered or provisioned; the amount of the payment or provision, and other information required to determine the nature of services provided or services provided to the recipient; and a description of the services provided or services provided in the possession or control of the recipient. (See Notice 2007-60, 2025 IRS Notice 2007-26, IRM 5.21.5, Nonresident Aliens). The information is to be provided on Form 8938, or any successor form, in electronic form. A copy of the completed Form 8938 will be provided along with the required information to the recipient.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form Instructions 8938 San Diego California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form Instructions 8938 San Diego California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form Instructions 8938 San Diego California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form Instructions 8938 San Diego California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.